The Surge in Climate Risk Reporting

Reporting on climate-related risks and opportunities is becoming front and center for corporations amid growing pressure from investors and governments. For example, last month the Securities and Exchange Commission (SEC) in the United States unveiled proposed regulations that would require certain companies to disclose their greenhouse gas emissions, as well as their exposure to climate-related risks. In December 2021, the Canadian Prime Minister, in his sessional mandate letters to his deputy prime minister and environment and climate change minister, instructed them to move towards mandating climate-related disclosures.

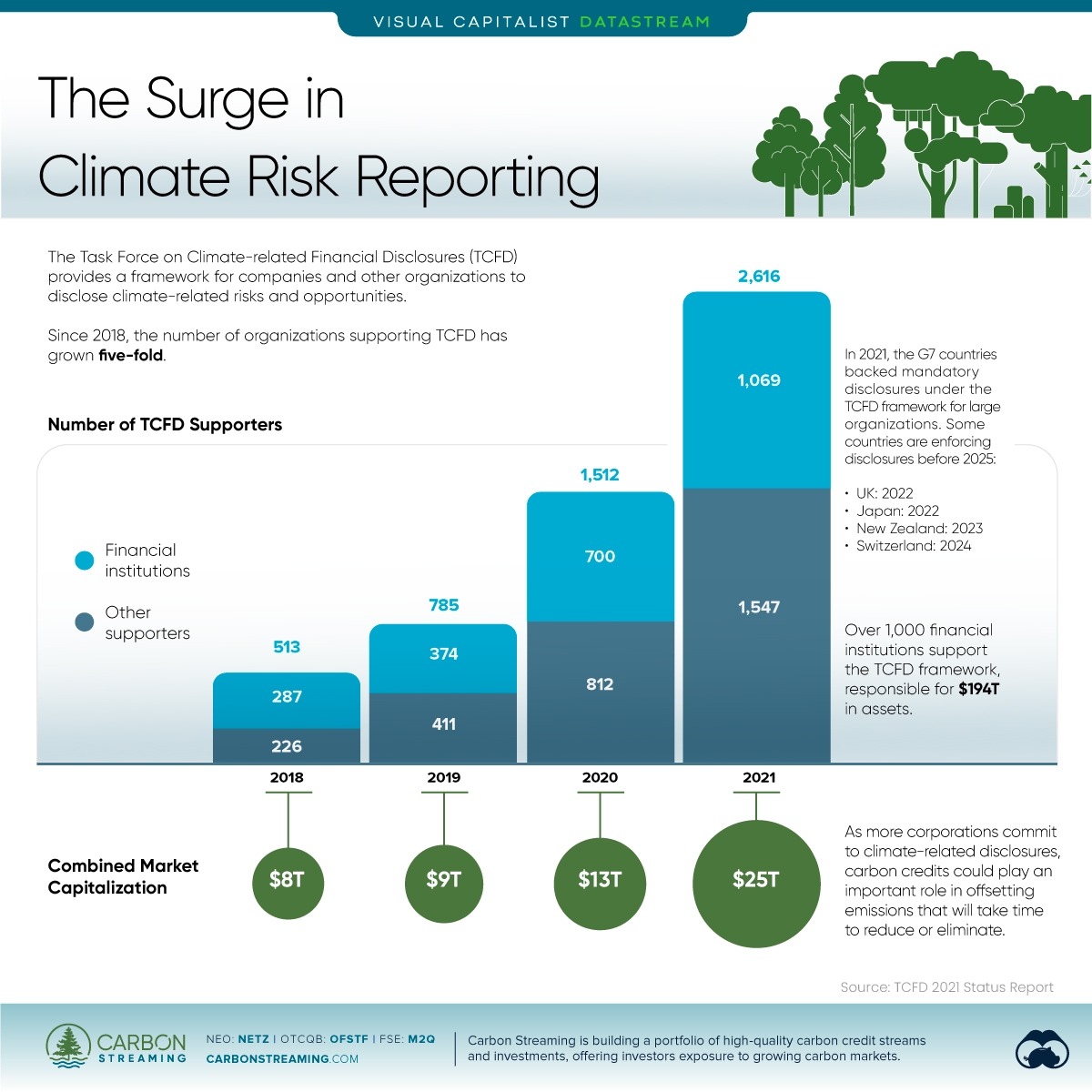

The Task Force on Climate-related Financial Disclosures (TCFD), created by the Financial Stability Board (FSB) in 2015, provides a global framework for such disclosures. The number of organizations supporting TCFD has grown five-fold in just three years. The following graphic created by Visual Capitalist charts the rapid growth in support for climate risk reporting under the TCFD framework.

Forward-Looking Information: Some of the posted entries on the Carbon Blog may contain forward-looking information. Forward-looking information address future events and conditions which involve inherent risks and uncertainties. Actual results could differ materially from those expressed or implied by them. For further information about the risks, uncertainties and assumptions related to such forward looking information we refer you to our legal notice.